Contents:

No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account.“

Double Top and Double Bottom Patterns are extremely reliable patterns which work better in longer timeframe charts like Daily and higher timeframes compared to intraday timeframes. By adopting these tools in your trading arsenal, you can improve the effectiveness of your trading. At times, you can find these patterns easily by simply enabling Auto-Support/Resistance in Investar, which can help you spot these patterns easily. As with most patterns, the triple backside is easiest to recognize as soon as the trading opportunity has passed. Double bottoms might fail and turn into a triple backside, and the triple backside and the top and shoulders pattern can, by definition, be one and the identical.

- A transfer beneath help or the sample low would clearly negate a breakout.

- Traders should always use double top and double bottom chart patterns with other indicators such as volume for confirming the reversal before taking a position.

- A Double Bottom chart pattern is a bullish trend reversal chart pattern.

- Such a sharp pickup in volume during breakout of a resistance highlights the determination of bulls to buy at higher levels and thereby increase the odds of price heading higher.

- Talking about the volume characteristics, volume should usually be high during the first part of the pattern when price is declining.

When a trader identifies a double bottom pattern, it suggests that there is a viable opportunity for entry. Traders consider this beneficial as it indicates that the stock may not plummet any further since a critical level of support is already achieved. Finally, at a certain point during the trading activity, a break in the resistance occurs beyond the highest point that was reached in between the two troughs.

Forex Trading Training

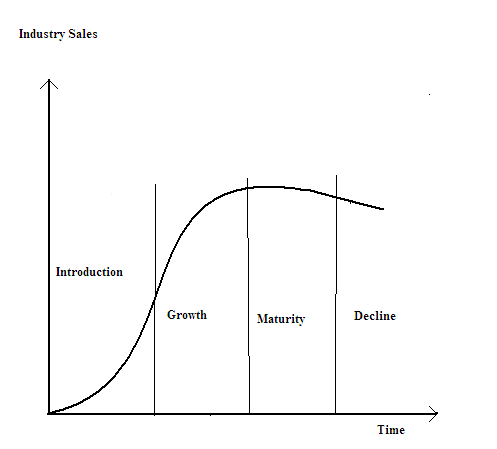

“Traders can buy the stock for a decent upside target projected at 260 levels with a holding period of the next 2-3 quarters,” he added. Triple bottom patterns are just extension of double bottom patterns. Gives an idea of market trend reversal in the medium to long term. Once you understand which phase market is in accordance with pattern formation, it will be easier for you to place the trade at the right time. This signals the start of a sell-off until the prior low is hit.

With the year drawing to a close, your thoughts may have turned to taking a holiday and visiting a new destination. Or you may want to just curl up in a blanket and laze around by a bonfire. While you do deserve some rest after toiling for the entire year, one essential task you must not overlook is to check your financial portfolio and ensure it is in good shape. Investments in securities market are subject to market risk, read all the related documents carefully before investing. In the case of the Double Bottom chart pattern, the stop loss should be placed at the second bottom of the pattern. In the case of a Double Top chart pattern, the stop loss should be placed at the second top of the pattern.

An ascending broadening pattern is a bearish reversal pattern that usually appears at the end of an uptrend. An ascending broadening pattern has two trendlines that are diverging. This pattern is characterized by higher highs and horizontal lows. A Head & Shoulder top is a bearish reversal pattern that appears after a rally in price. Of all the patterns that we will be discussing in this chapter, an expanding broadening pattern is arguably the most difficult to trade.

Stocks to buy: Analysts recommend betting on these 9 picks for the short term – MintGenie

Stocks to buy: Analysts recommend betting on these 9 picks for the short term.

Posted: Mon, 20 Mar 2023 07:39:46 GMT [source]

When buying pressure accelerates and volume builds up, a change in the sentiment is experienced towards the initial resistance level. Bears can start their buying activity when they observe that a breakout has occurred. The pattern starts taking shape towards the end of a sustained downtrend, which was apparent for weeks or even months.

NIFTY Research report: Elliott Wave And Sentiment Analysis

Wait until the break happens before deciding to initiate a trade. Just keep in mind that contracting triangles are more likely to continue the prevailing trend rather than reverse it. The reason I don’t trade the standard double bottom technique anymore is because the reward to risk ratio is not good enough. Some traders use the traditional take profit target to partially close their position, leaving the remaining position to ride the trend . The next technique is more aggressive and provides a better risk to reward scenario. In this technique, you wait for a candlestick to open and close above the trendline.

Similarly, in some cases, when price is trading within the triangle, volume picks up modestly during declines and fades during rallies. This usually, but not necessarily, indicates that the break could be on the downside, especially if the trend before entering the pattern was down. The break from the triangle, however, must be accompanied by an increase in volume. Notice in the chart above the marked pickup in volume during the breakout of the neckline. Keep in mind that volume is more important in case of an inverse H&S pattern than it is in case of a bearish H&S pattern.

How Do We Trade The Rounded Bottom?

The Double Bottom is a bullish reversal pattern that is formed after the downtrend. Double bottom chart pattern occurs at the bottom of a downtrend. This pattern is considered to be bullish and suggests that the cryptocurrency’s downward trend may be reversing and that the asset may be about to experience upward momentum.

- A double bottom reversal pattern occurs after an extended downtrend.

- A H&S top is a bearish reversal pattern that appears after a rally in price.

- Proponents of this system imagine that focusing solely on worth changes eliminates day-to-day market noise.

- The above chart shows a descending triangle pattern acting as a bearish continuation pattern.

In other words, the extent of the double bottom candlestick pattern bottom pattern formation indicates the size of the potential advance. As with many chart patterns, a double bottom pattern is best suited for analyzing the medium to longer-term view of an asset. Generally, longer the duration between the two lows in the pattern, greater the probability that the chart pattern will be successful. At least a two weeks to three-month duration between the two lows is considered appropriate.

Trending Now

As presented, the price line touches two lows, forming the shape of the English alphabet ‚W.‘ The graph shows that the first low marks a drop of 10% and the other low is almost the same. Also, the second drop breaches the support level, confirming the pattern. This pattern is formed with two lows below its resistance level which is also known as the neckline. Double Top and Double Bottom is a type of price reversal patterns. This pattern has a body near the high, and a long downwards wick.

If prices do not come to the neckline and the next retracement entry is in place, you can again place your stop loss 1 ATR far from the level from which the prices retrace. If prices do come to support at the neckline, your stop loss should be 1 ATR below the neckline. If you understand the workings of the pattern as explained in the previous section, you will have no trouble trading it.

As stated earlier, price patterns can also be plotted on line chart. Notice the three identical bottoms, and notice the two intervening lows that are ascending rather than horizontal. This is fine give that the second peak is only slightly above the first peak. Also notice how volume contracted during the first two bottoms but then expanded sharply during the advance from the third bottom.

After the completion of this pattern, the price trades in a small range at the right side of this pattern and looks like a Handle to the Cup. The pattern gives a breakout confirmation when the price crosses the higher side of the Cup or the resistance zone. Chart patterns are used mainly by short-term traders, as a pattern is formed on a different time frame and represent the psychological and fundamental factors. With the help of a pattern, a trader can identify specific entry and exit points and adequately manage the trade.

If that happens, you enter at the open of the next https://1investing.in/ . If you’re going to use this technique, I recommend moving your stop loss to break even before price makes it back up to the breakout line. The breakout line often acts as resistance, so it’s a good idea to move your stop to break even, as long as your trade still has a little room to breath. The reason I haven’t continued to trade this technique is because the reward to risk is still not good enough. The risk to reward scenario is better in this aggressive entry, but the strike rate is also lower because you’re not waiting for the double bottom to be confirmed . This last technique is the way I like to trade the double bottom chart pattern.

Again, keep some flexibility when looking out for triple bottom patterns. It is relatively rare to find three bottoms and two intervening highs at exact levels. Sometimes, the bottom or the intervening peaks might be slightly ascending or descending rather than horizontal. The pattern is formed with three peaks in which the height of the middle peak is higher than the other two peaks. Similarly, when this pattern forms at the bottom of the rally in reverse form, it is called an Inverted Head and Shoulders pattern, a bullish trend reversal pattern.

Combining hidden divergence with this chart pattern or even regular divergence between the left shoulder and head of this pattern can help to qualify good trading setups. As a bullish reversal pattern, a true inverse head and shoulders will only occur at the bottom of a trend. Taking these patterns out of context is an easy way to ruin their effectiveness and lose money. Talking about volume characteristics, volume tends to decline when within the triangle. However, being a bearish continuation pattern, when price is trading with the triangle, expect modest upticks in volume during declines and downticks in volume during advances.