Solution Financing Alternatives

Even though you perform qualify for federal college loans, they often do not promote adequate money for each and every semester to spend any studies will cost you. He’s a limit for every session you qualify. For many who check out a college where tuition will set you back more just what federal loans can give while can not rating private fund, you might have to check almost every other funding alternatives.

Signature loans

There’s nothing incorrect that have having fun with signature loans to own expenses whenever you can qualify loan quick cash New York for him or her. Of many people currently make use of them to cover for extra expenditures. The biggest drawback, however, comes in their interest prices. These are greater compared to those you can aquire off scholar fund, which have some of the reasonable cost worldwide.

Another prospective issue is you to definitely personal loans shall be hard to be eligible for. There’s two different kinds of signature loans you could get: covered and you will unsecured. To help you be eligible for a protected financing, you need a form of guarantee their lender may take if the that you do not pay off your debt. For instance, you might have to set up this new equity of your house and you can auto in order to keep the mortgage. You will additionally you would like a good credit history and you may money in this a good specific bracket.

It’s always even more difficult to find acknowledged having an enthusiastic consumer loan than it is having a secured one to. It is because it is much harder for the bank to collect their money. For individuals who default, the lender must take you to judge.You don’t need to place on any guarantee, you must illustrate that you are a decreased exposure so you’re able to the lending company.

Lenders commonly exhaustively consider throughout your credit file to find people prospective circumstances. They could would also like to adopt your lender comments so you’re able to be sure to have enough money in the set aside to make your loan money if the anything goes your income. The lender would want to be certain that your revenue count plus a position state.

Instead, you might like to score a good cosigner with a good credit rating. Cosigners offload some of the threats toward lenders, that may alter your chances of bringing accepted.

Fees terminology are much less positive as what you are able get that have figuratively speaking. The financial institution usually will give you a predetermined fees agenda or base it toward fluctuating interest of your financing. This can ensure it is tough to pay back the borrowed funds when anything wade pear-shaped.

Credit cards

Another option is actually financing through handmade cards. The greatest advantage of this is the fact it’s easy doing. Just about anyone could possibly get acknowledged to have credit cards. More over, such cards do not have partners limits precisely how they’re spent. You don’t need to fill in more loan applications otherwise value how much money you create to locate accepted to own the financing. As an alternative, you only supply the charge card amount toward school’s bursar’s work environment.

Despite this, financing their studies towards plastic material isn’t the best choice. The attention rates by yourself are some of the extremely punitive in the a great deal more than 20% in some cases. After you use those rates of interest so you can $30,100000 otherwise $50,one hundred thousand within the degree will set you back, you will be purchasing an astronomic amount of money when you look at the notice. It could take the rest of your daily life to invest off the obligations for individuals who only improve minimal money on the the charge card profile.

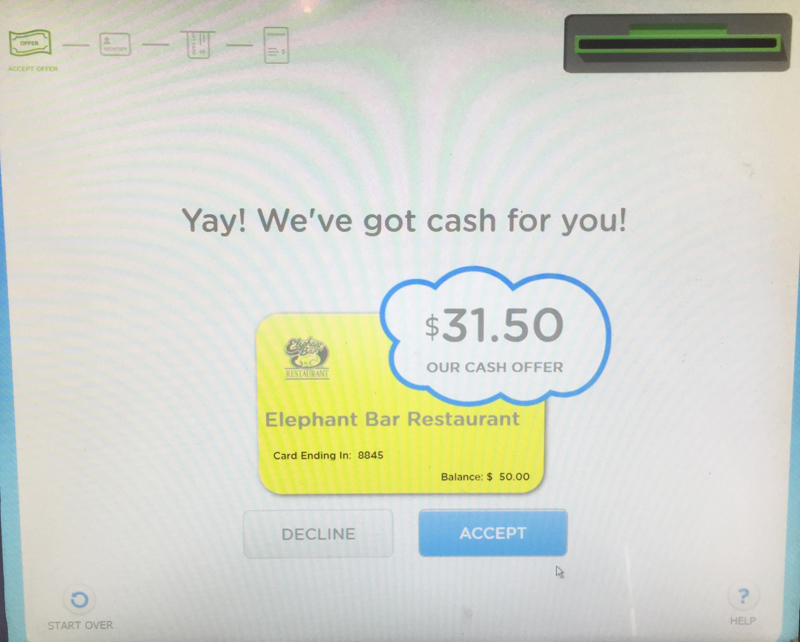

One of several sweet aspects of credit card use is the fact you might make use of benefits applications, which provide your activities for every dollars that you devote to the card. Particular playing cards gives you double or triple affairs during the advertisements. As a result you might accumulate a highly higher factors equilibrium by paying to have school that have credit cards. Make use of these things to pay money for a no cost travel, electronics for the dorm room, otherwise rating current licenses. While this isn’t really a adequate reason to use playing cards to cover the college or university, it comes down while the an enjoyable added bonus if you are intending into the doing it in any event.