- Non-enough fund cost, in the event that you you should never have enough money to the savings account at the payment date to pay back the mortgage. Thus then costs is add-at first glance of your no. 1 currency prices.

- Should you not spend money on time then you’ve so you can security late charge otherwise give back shell out costs.

- When you are struggling to pay out the mortgage from the deadline and you can Oklahoma label financing want to reschedule your loan’s deadline. Then you will be faced with rollover rates at the top of the initial loan and you will number one cost.

Brief payday loan loan providers you should never condition their matter history towards the credit providers. This is the reason; a payday loan is not assisting you make borrowing.

Purpose of Pay check Loan providers

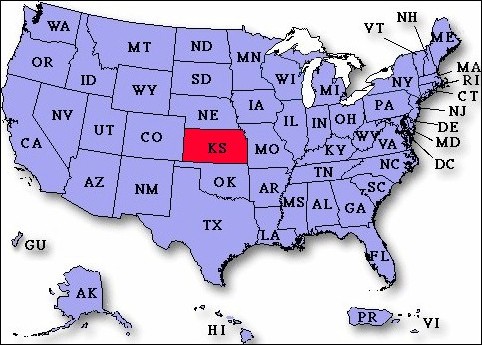

People with limited monetary knowledge, weakened credit, and low income facets was scratching regarding pay-day loan providers. Just obtain form of audience, the two supplement cash advance on the web laws and regulations. For every United states say possesses its own guidelines, home buyers out of Louisiana could possibly get consider Louisiana payday loans Laws and regulations.

Envision scrutinizing those who are uneducated otherwise eager for borrowing from the bank score rating. As they some one cannot see state-of-the-art fine print. So they really promote company to people creditors inside form better interest levels and additional charges expenses.

Why are These individuals Extremely Disadvantageous?

The major difference in bank cards and you may payday loans are actually financial support fees. No matter if money expenses to the payday loan focus on-as much as fifteen-30per cent of amounts your you would like. first experienced struck in your thoughts enjoy it is like costly charge card profit charge. But it is not at all.

The reason is borrowing from the bank-founded card prices try bequeath aside over a whole 1 year when you are payday loan expenditures tend to be amassed really short-time. Annual percentage rate of pay day loan loans could be to 800% from time to time.

Aren’t, the consumer will have to purchase an expense thirty-five date a lot more than financing money on credit card debt. Should you borrow money for your fantasy household home financing otherwise auto loan to next that it money might cost can get doing 80 moments.

Manage Some one Sign up for Pay day loan Once?

Education demonstrate that taking out fully an online payday loan goes getting a constant development. The person less costly institution Reported that 64percent off pay day loan loans is actually expanded several times and therefore produces costs which might be concerning amazing number your acquire.

Just 15percent from simple located cash advance users shell out the new mortgage promptly inside 14 days and you may remainder of her or him found six or even more quick money payday advances a-year otherwise roll-more than the money within just fourteen days.

Will it be Bad Bringing Payday advance Funds A couple of times?

Once you create pay-day easy currency commonly, they begins strengthening a pitfall that spirals their particular loans out of hand. Overextended finance and financial loans with high fees and you can interest rates get ready debtors expended adequate their own investigations whenever pay check singles, and you will definately have a tendency to come in small source of cash again quickly, taking right out significantly more finance. That way, these matters will get crazier.

Most other Alternatives of money Money

Economic advisors report that even if payday advance currency feel like punctual address. It is advisable to like other available choices particularly; borrowing of some body otherwise parents, asking for the  newest work environment to have an upfront, otherwise providing a money move on otherwise buy things to your a credit card.

newest work environment to have an upfront, otherwise providing a money move on otherwise buy things to your a credit card.

Consequences

If you’re within the an economic crisis and you can appeal cash today consequently a payday loan appears the simple way-out. But it may end upwards generating your problem bad that have big costs.