Eligibility

Eligible brief organizations, you to definitely together with their affiliates (if applicable), keeps five hundred otherwise a lot fewer team, and additionally nonprofits, veterans‘ organizations, tribal questions, self-employed anyone, best proprietorships, and you may separate contractors can apply.* Organizations along with five hundred personnel in some areas, one to meet with the SBA’s option size practical otherwise size requirements having the individuals opportunities, can also pertain.

Established PPP consumers that did not located financing forgiveness from the can get (1) reapply to own a primary Draw PPP Mortgage if they previously came back specific otherwise each of their Earliest Draw PPP Mortgage fund, otherwise (2) not as much as specific issues, consult to change the Earliest Draw PPP Amount borrowed once they prior to now did not accept a full count wherein these people were qualified.

Borrowing Ability

For most consumers, the most loan amount out-of an initial Mark PPP Financing try 2.5x an average monthly 2019 or 2020 payroll will set you back to $10 mil. To possess borrowers trying to get a boost in its First Mark PPP Financing, the period employed for calculating month-to-month payroll costs for the first software would be used to influence borrowing capabilities.

Step 1: Aggregate payroll will cost you (defined below) out-of 2019 or 2020 to have staff whose dominant host to home is the You.

Step 2: Subtract people compensation paid down to an employee in excess of $a hundred,one hundred thousand into the a keen annualized basis, due to the fact prorated for the months during which the brand new repayments are available and/or duty to make the repayments was sustained.

Step 5: Add the a good quantity of an economic Burns Emergency Loan (EIDL) generated between that you attempt to re-finance. Do not are the quantity of one “advance” less than a keen EIDL COVID-19 financing (because need not end up being paid off).

Payroll will cost you feature settlement in order to staff (whoever dominating place of home is the us) in the way of salary, earnings, commissions, otherwise comparable compensation; dollars resources and/or comparable (based on boss records away from early in the day info otherwise, from the absence of such as ideas, a reasonable, good-faith manager imagine of these information); percentage having travel, adult, household members, medical, otherwise ill exit (except those paid off log off quantity whereby a credit is enjoy underneath the Parents First Coronavirus Response Operate, Sections 7001 and 7003); allowance getting separation or dismissal; commission on the provision off personnel experts (as well as insurance premiums) consisting of class healthcare exposure, class lifestyle, handicap, sight, or dental insurance plans, and pensions; payment of county and you may local taxes examined on compensation out of professionals; and, to have a separate specialist otherwise only holder, salary, earnings, earnings, or websites earnings off care about-a position otherwise comparable payment.

Additional information on ideas on how to calculate limitation loan amounts (because of the organization method of) have the fresh new Interim Final Laws into Income Protection System as Revised, create into January six.

Needed Files

- In case your candidate is not worry about-functioning, the newest applicant’s Setting 941 (and other taxation variations with similar recommendations) and state quarterly salary jobless insurance coverage tax reporting versions out-of for every single one-fourth in 2019 otherwise 2020 (any was used so you’re able to assess payroll), since applicable, otherwise equivalent payroll chip records, together with proof one old age and you may personnel class health, lifetime, impairment, vision and you will dental insurance benefits, need to be provided. A partnership also needs to are their Irs Function 1065 K-1s.

- Should your candidate is actually thinking-employed possesses employees, the fresh new applicant’s 2019 otherwise 2020 (whatever was applied so you can calculate amount borrowed) Internal revenue service Mode 1040 Plan C, Setting 941 (or any other taxation variations or comparable payroll processor chip info that has had equivalent information) and you can state every quarter salary jobless insurance tax revealing forms regarding for each quarter when you look at the 2019 or 2020 (whichever was utilized in order to determine loan amount), given that relevant, or equivalent payroll processor chip ideas, as well as proof of people old age and you may staff class fitness, existence, handicap, attention and you may dental insurance plans contributions, in the event that appropriate, should be provided. An excellent payroll report or similar paperwork regarding the shell out months you to protected need to be provided to establish the new candidate was in procedure on .

- In case your candidate was notice-employed and won’t have personnel, the fresh new candidate ought to provide (a) its 2019 or 2020 (whatever was utilized so you’re able to determine amount borrowed) Function 1040 Schedule C, (b) a beneficial 2019 otherwise 2020 (any kind of was utilized to calculate amount borrowed) Internal revenue service Function 1099-MISC detailing nonemployee compensation acquired (package seven), charge, lender declaration, or guide out-of list one set that the candidate was worry about-employed; and you will (c) a good 2020 charge, lender declaration, or guide out-of checklist to determine that candidate was a student in

process into the .

process into the .

What’s Second

We expect to get a hold of participating lenders accepting applications having fun with individuals platforms and you may timeframes. Companies should think about locations to incorporate, have a look at eligibility and you can collect the appropriate documentation into the particular application(s).

Help Aprio Let

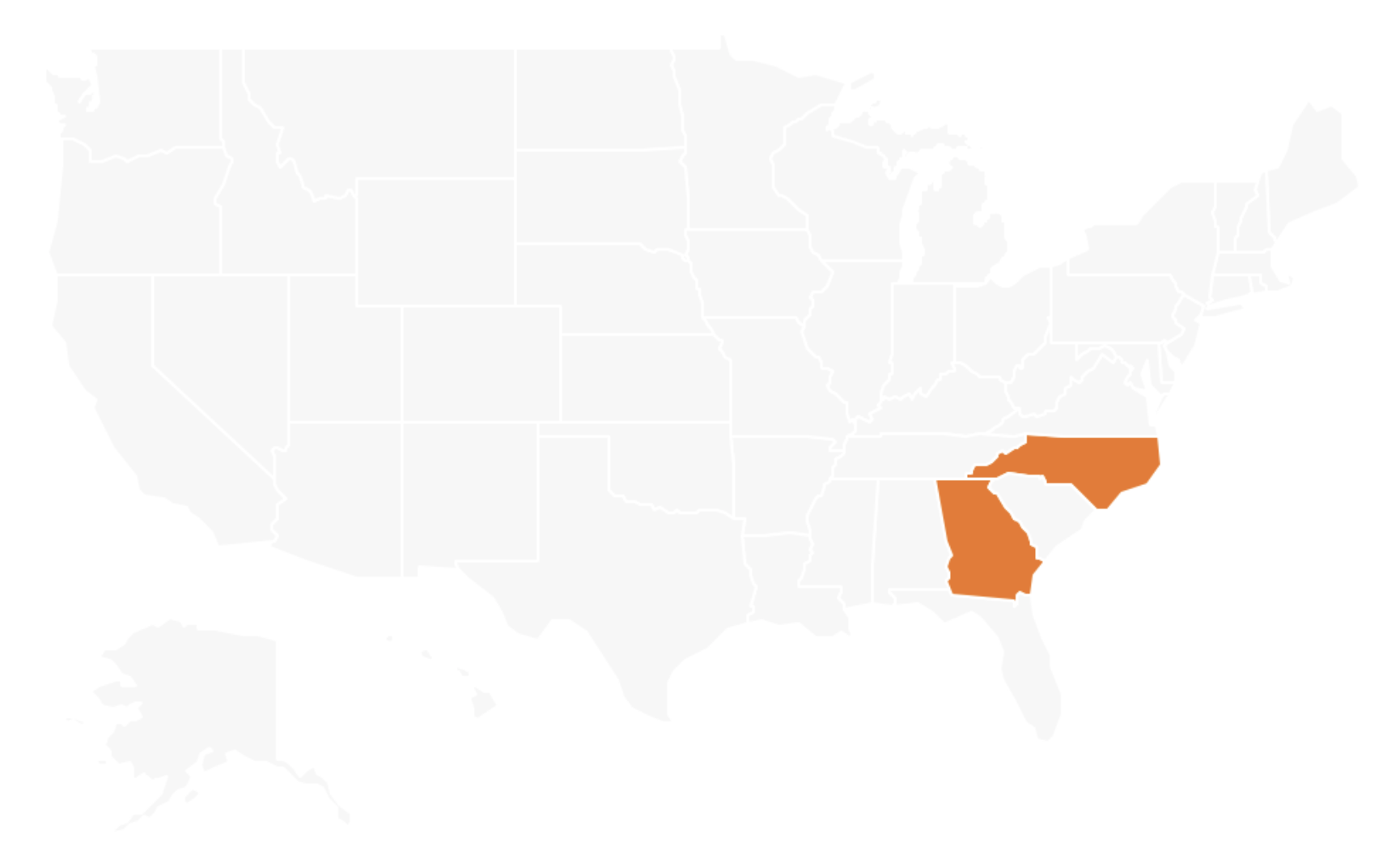

which is constantly monitoring the fresh new advice on SBA, and Treasury, Congress additionally the Irs, to ensure we have the latest guidance when telling our very own clients.

To talk about ideas on how to determine your qualification having an initial Mark PPP Financing (in addition to increases thereto) and you will precisely determine your credit capability, contact .

Aprio’s objective is to provide the most current pointers, including our very own expertise and you will most recent understanding of this type of software and you will statutes in order to browse your online business reaction to COVID-19.

The principles away from SBA applications are continuously being refined and you will clarified from the SBA or other providers In some days, the new pointers are provided by the brand new agencies and you will/or perhaps the financial institutions is in lead dispute with other fighting suggestions, laws and regulations and you will/otherwise established guidelines.

Because of the growing characteristics of state plus the lack off finally published laws, Aprio you should never ensure that even more transform or reputation will not be necessary otherwise forthcoming additionally the brand-new advice provided by Aprio are influenced by the fresh new developing characteristics of your problem.

You ought to take a look at and you will draw their conclusions and discover their Organizations ultimate way in accordance with involvement in these applications based in your Company’s particular situations, income anticipate and business strategy.

Where information are offered by businesses, those services would be secure lower than another type of agreement physically which have you to definitely provider. Aprio is not accountable for what of any most other third group.

Aprio prompts one get hold of your legal counsel to address the fresh court effects of your own impact of one’s CARES Act and you can specifically your contribution in every of the SBA software.

APRIO, the Aprio pentagonal pinwheel representation,“Passionate To possess What is Second”, together with “ISO 27001 Authoritative By the APRIO” close, is registered marks off Aprio, LLP. “APRIO Cloud” are a support -21. Every liberties reserved.